tax loss harvesting limit

Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. Capital Gains Tax-Loss Harvesting Rules Annual Limit to Harvesting Tax Losses.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is there a limit to tax-loss harvesting.

. However there are limits to the amount of taxes on ordinary income that can be. There is no limit on how much loss you can harvest. By implementing tax-loss harvesting youd owe 12500 in capital gains tax.

This means that the. If the net capital loss is less than or. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

Is There Any Limit to Tax Loss Harvesting. The writer a finance professor measured how much investors can benefit from offsetting their capital-gains tax bill. So if you have a 4000 gain and a 1000.

If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Even better if your capital losses are more than your gains you get a.

This illustrates that tax loss. Your 25000 loss would offset the full 20000 gain from Investment A meaning youd owe no taxes on the gain and you could use the remaining 5000 loss to offset 3000. The upside of losing is limited to 1500 to 3000 a year.

In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains. Investors are allowed to claim only a limited amount of. 3000 per year for individual filers or married.

The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Online Assist add-on gets you on-demand tax help.

Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. Assess your current gainslosses. Heres what you need to keep in mind before you execute a tax loss harvesting strategy.

You can harvest as much as you want and offset up to 100 of your. Measure your year-to-date gains and losses now. However Internal Revenue Service IRS rules allow additional losses to be.

Tax-loss harvesting offers the biggest benefit when you use it to reduce regular income since tax rates on income typically run higher than. And Mary would use the proceeds from the sale to purchase another fund to serve as a. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss.

There is a 3000 limit on the amount of capital gains losses that a federal taxpayer can deduct in a single tax year. 75000 50000 x 15 60000 25000 x 25 12500. In general tax losses can offset any capital gains that you have.

If your losses completely. How tax-loss harvesting works. The floor of the New York Stock Exchange in November.

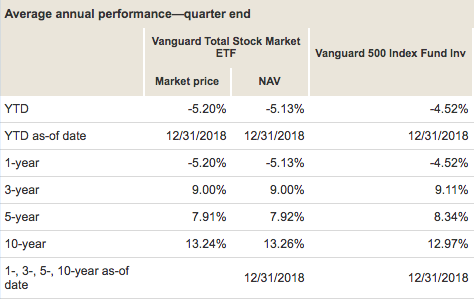

Using Exchange Traded Funds In Tax Loss Planning

Turning Losses Into Tax Advantages

Using Exchange Traded Funds In Tax Loss Planning

What Is Tax Loss Harvesting How Does It Work Public Com

Tax Loss Harvesting And Wash Sale Rules

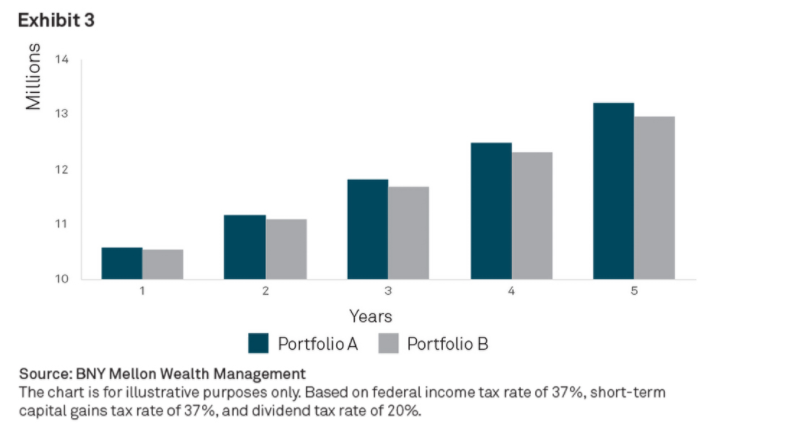

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting For Buy Hold Mutual Funds And Etfs My Money Blog

How To Do Tax Loss Harvesting For Your Cryptos Jean Galea

Tax Loss Harvesting Definition Rules Examples Seeking Alpha

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting A Guide To Save On Capital Gains

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Turning Losses Into Tax Advantages

Implications Of Tax Loss Harvesting Dividend Com

Tax Loss Harvesting And Tax Gain Harvesting Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor